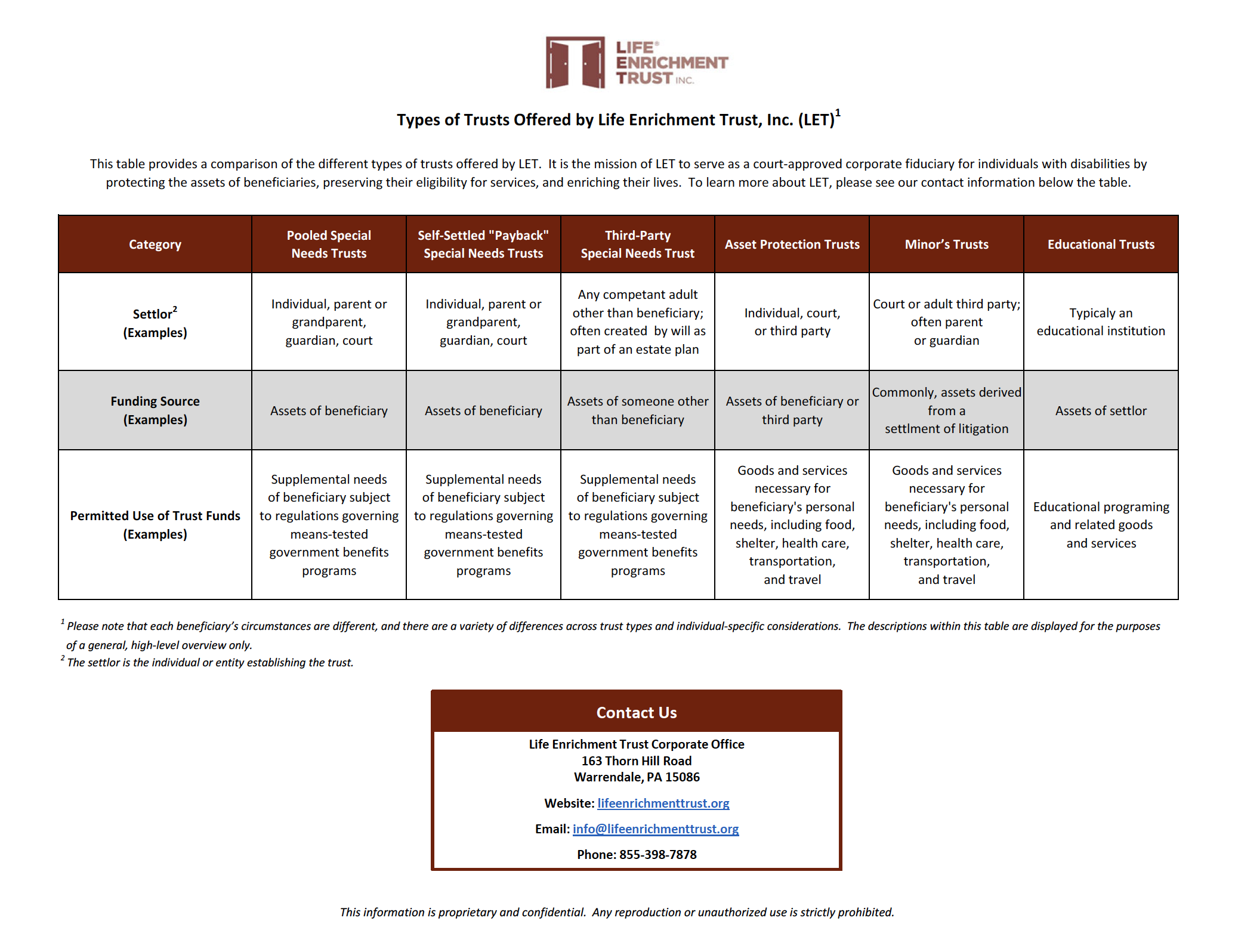

Types of Trusts Offered

A pooled special needs trust protects assets for individuals (beneficiaries) with disabilities and is managed by a non-profit organization, as the trustee. Each beneficiary who is a part of the pooled special needs trust has their own account within the pooled special needs trust, and the accounts are pooled together for investment and management. The beneficiary’s accounting, deposits, and disbursements are tracked to each beneficiary’s specific account within the pool. The beneficiary can access funds within a pooled special needs trust according to the specifications of the executed trust documents and in accordance with the Social Security Administration’s Program Operations Manual System. Assets within a pooled special needs trust are not counted as part of the beneficiary’s assets when determining eligibility for Social Security Income, Supplemental Security Income, or Medical Assistance / Medicaid.

A self-settled “payback” special needs trust established for the benefit of a beneficiary with a disability and is funded by the beneficiary, often through a court settlement (e.g., personal injury or malpractice) or an inheritance. The beneficiary can access funds within a self-settled “payback” special needs trust according to the specifications of the executed trust documents. Assets within a self-settled “payback” special needs trust are not counted as part of the beneficiary’s assets when determining eligibility for Social Security Income, Supplemental Security Income, or Medical Assistance / Medicaid.

A third-party special needs trust established for the benefit of a beneficiary with a disability and is funded by someone other than the beneficiary (e.g., a family member). The beneficiary can access funds within a third-party special needs trust according to the specifications of the executed trust documents. Assets within a third-party special needs trust are not counted as part of the beneficiary’s assets when determining eligibility for Social Security Income, Supplemental Security Income, or Medical Assistance / Medicaid.

An asset protection trust holds designed assets of a beneficiary in a trust account that is managed by a specified trustee. The beneficiary can access funds within an asset protection trust according to the specifications of the executed trust documents. Assets within an asset protection trust are protected against potential creditors and are not counted as part of the beneficiary’s assets when determining eligibility for Social Security Income, Supplemental Security Income, or Medical Assistance / Medicaid.

A minor’s trust is established to manage and protect assets of a child they reach a specified age. The trust documents of the minor’s trust will specify the types of disbursements from the trust that are permissible from the trust until the minor reaches the specified age within the trust documents, at which time the trust’s assets are transferred to the beneficiary by the trustee.

An educational trust is established to protect assets for a beneficiary to use toward supporting their education. The trust documents of the educational trust will specify the types of educational purposes that the trust funds can be utilized for.